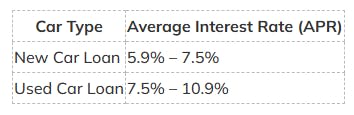

When you are planning to finance a new car or an old car in Canada, you might face the age-old dilemma: which one is better, used vs new car loan rates? The average interest rates for used cars and new cars can highly impact the overall costs you will pay to the dealership by the end of your loan term. For car buyers in Canada, understanding new vs used car interest rates is vital to make a financially sound and smart decision.

This blog will help you understand how interest rates on new cars vs used differ, and which car loan British Columbia you should consider for yourself. By the end of this blog, you will be able to navigate this decision easily.

![British Columbia Used Car Tax | Used Vehicle Tax In BC [2025]](https://images.prismic.io/autolendinghub/aBA3OvIqRLdaBsPl_midsection-customer-signing-contract-table_1048944-6900322.avif?auto=format%2Ccompress&rect=0%2C52%2C626%2C313&w=3840&fit=max)

![How Much Credit Score is Required For Car Loan in Canada? [2025]](https://images.prismic.io/autolendinghub/Z5peVpbqstJ9-AaC_pexels-photo-7236362.jpeg?auto=format%2Ccompress&rect=0%2C94%2C1125%2C563&w=3840&fit=max)

![How To Avoid Paying Taxes On Used Car Purchases In BC [2025]](https://images.prismic.io/autolendinghub/Z0GBlq8jQArT1Oj8_image3.png?auto=format%2Ccompress&rect=0%2C177%2C1127%2C564&w=3840&fit=max)