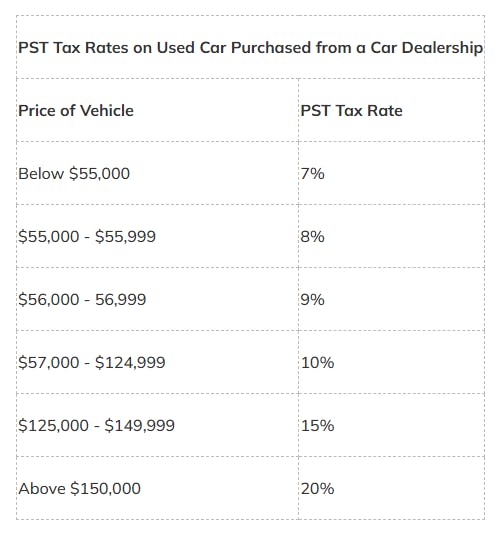

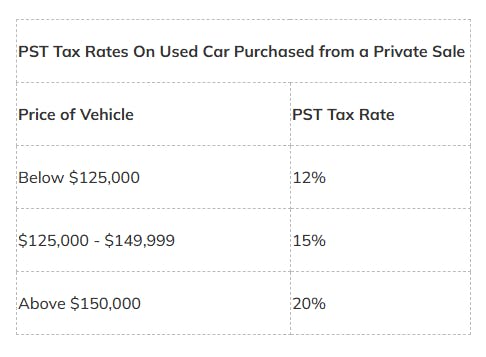

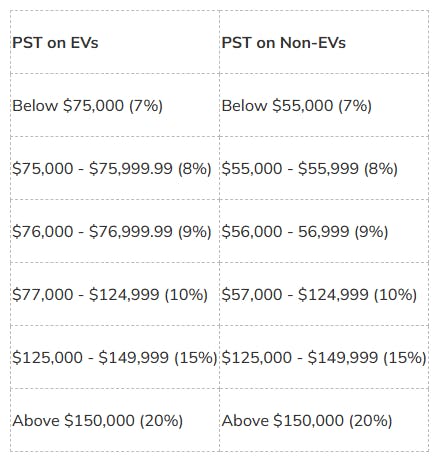

We understand the struggle of trying to understand the British Columbia car sales tax. Most of the time, it feels like a lot of numbers, where most people try to help but fail to provide any guidance on the topic of car tax British Columbia! Trying to work your way through British Columbia car tax and car loan rates british Columbia can feel like an unsolved puzzle, where you are trying to piece everything together with no hope!

So, what is the British Columbia tax on used vehicles? Is there any way to understand the tax on used vehicles in British Columbia for a car loan British Columbia? Lucky for you, because we have simplified British Columbia tax on vehicles to help you find the answers to what tax is paid on used cars in BC and British Columbia luxury car tax!

![British Columbia Used Car Tax | Used Vehicle Tax In BC [2025]](https://images.prismic.io/autolendinghub/aBA3OvIqRLdaBsPl_midsection-customer-signing-contract-table_1048944-6900322.avif?auto=format%2Ccompress&rect=0%2C52%2C626%2C313&w=3840&fit=max)

![How Much Credit Score is Required For Car Loan in Canada? [2025]](https://images.prismic.io/autolendinghub/Z5peVpbqstJ9-AaC_pexels-photo-7236362.jpeg?auto=format%2Ccompress&rect=0%2C94%2C1125%2C563&w=3840&fit=max)

![How To Avoid Paying Taxes On Used Car Purchases In BC [2025]](https://images.prismic.io/autolendinghub/Z0GBlq8jQArT1Oj8_image3.png?auto=format%2Ccompress&rect=0%2C177%2C1127%2C564&w=3840&fit=max)