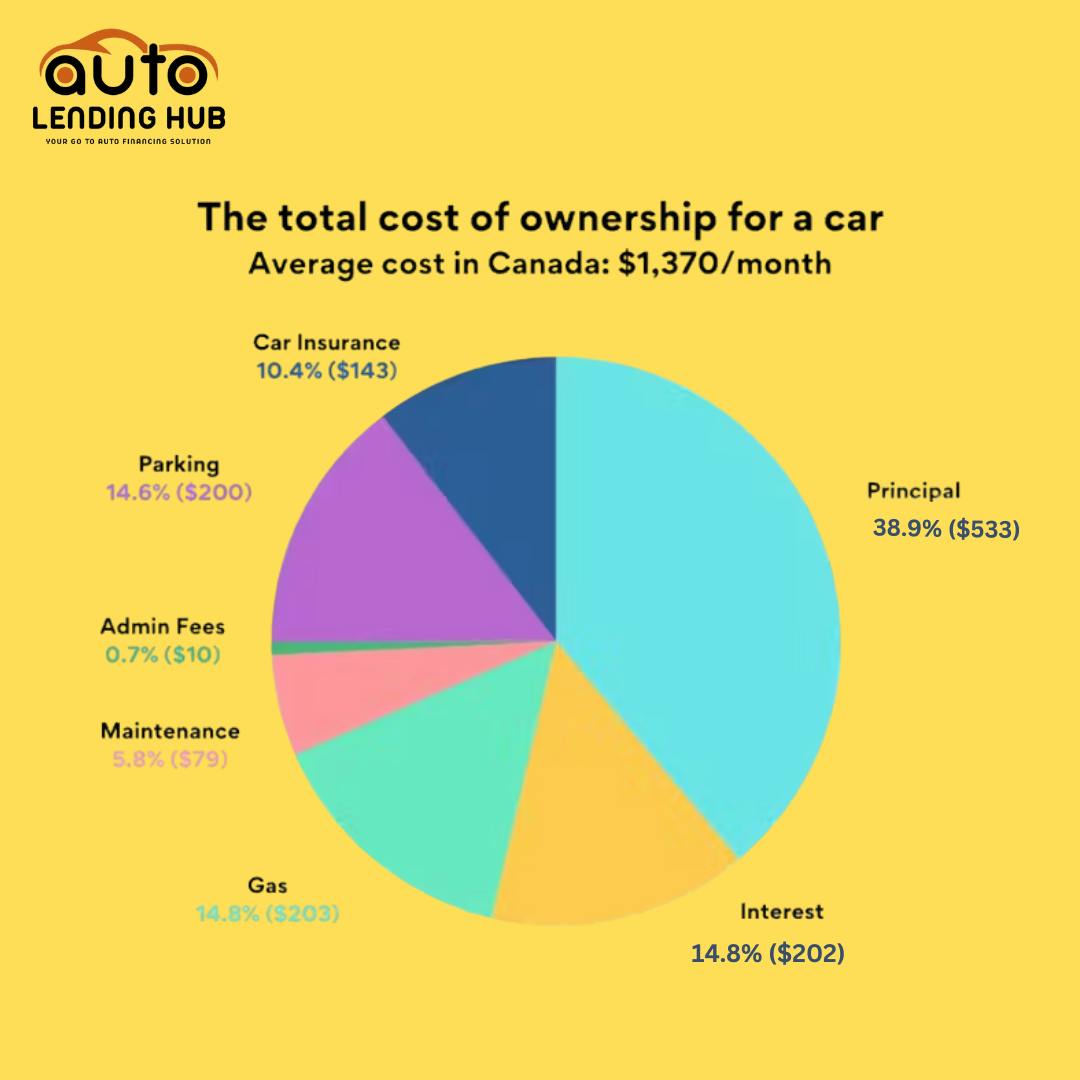

The purchase of a new car is a huge financial investment. When you prepare yourself for the costs involved in car ownership, you are not only navigating your finances more carefully, but you will also be able to pay for the costs of car loan Vancouver without many financial hurdles.

Over 84% of Canadians own a car. It's no surprise that the cost of ownership is a big concern for Canadians. Find out more about the prices you need to know before you buy a car in Vancouver through a dealership with the best rates in car loan rates British Columbia.

![British Columbia Used Car Tax | Used Vehicle Tax In BC [2025]](https://images.prismic.io/autolendinghub/aBA3OvIqRLdaBsPl_midsection-customer-signing-contract-table_1048944-6900322.avif?auto=format%2Ccompress&rect=0%2C52%2C626%2C313&w=3840&fit=max)

![How Much Credit Score is Required For Car Loan in Canada? [2025]](https://images.prismic.io/autolendinghub/Z5peVpbqstJ9-AaC_pexels-photo-7236362.jpeg?auto=format%2Ccompress&rect=0%2C94%2C1125%2C563&w=3840&fit=max)

![How To Avoid Paying Taxes On Used Car Purchases In BC [2025]](https://images.prismic.io/autolendinghub/Z0GBlq8jQArT1Oj8_image3.png?auto=format%2Ccompress&rect=0%2C177%2C1127%2C564&w=3840&fit=max)