The Different Types Of Taxes in BC

Before we delve deep into the blog, it’s important to understand the different kinds of taxes. By understanding the different kinds of taxes which are charged during the purchase of any good or service, we will develop a clear idea of sales tax on purchase of used cars. Whether you're shopping at Port Coquitlam car dealerships in BC or exploring options at Fort St. John auto dealers, knowing these taxes can help you make an informed decision. Let’s find out:

GST: Federal Goods and Services Tax is an indirect value-added tax levied on all goods and services within Canada. It’s a single tax which all manufacturers, sellers and consumers of any goods or service need to pay. In British Columbia, you need to pay 5% GST.

PST: Provincial Sales Tax is the tax levied by provinces on goods and services. Unlike GST and HST, it is not directly administered by the Canadian government. Each province has its own rules regarding the application and exemption of PST. You need to pay 7% PST in British Columbia.

HST: Harmonised Sales Tax is the combination of GST and PST in five provinces of Canada. It’s a consumption tax paid by local consumers and businesses. The name signifies the “harmonization” or the combination of the taxes. In British Columbia, you don’t need to pay any HST, but instead need to pay for both GST and PST separately.

How Are Car Sales Taxed In BC?

This is dependent on varying factors. Each province across Canada charges taxes at a different rate. British Columbia, as a province in Canada, plays by their own rules when it comes to taxes.

When it comes to BC, the taxes on the purchase of any vehicle would require you to pay GST and PST, irrespective of whether it’s new or used. It might get a little confusing, so it would be easier if we break down the entire process for you.

GST + PST = 5% + 7% = 12% Total Tax

The total tax which is levied on the purchase of vehicles would be 12%, new or old. There are more factors in play apart from this. The amount of PST varies with the value of the car purchased. To learn more about it, read the next section of the blog.

Taxes on Used Cars

While purchasing a used car from a dealership or private sale, you need to pay both GST and PST. The GST for used cars is always fixed at a rate of 5%, but the PST increases or decreases depending on the car’s value and sale price.

The value of the used car is dependent on the presence of damage or defects which may be found. For now, let’s understand the variations in PST depending on sale price and where you’re making a purchase from.

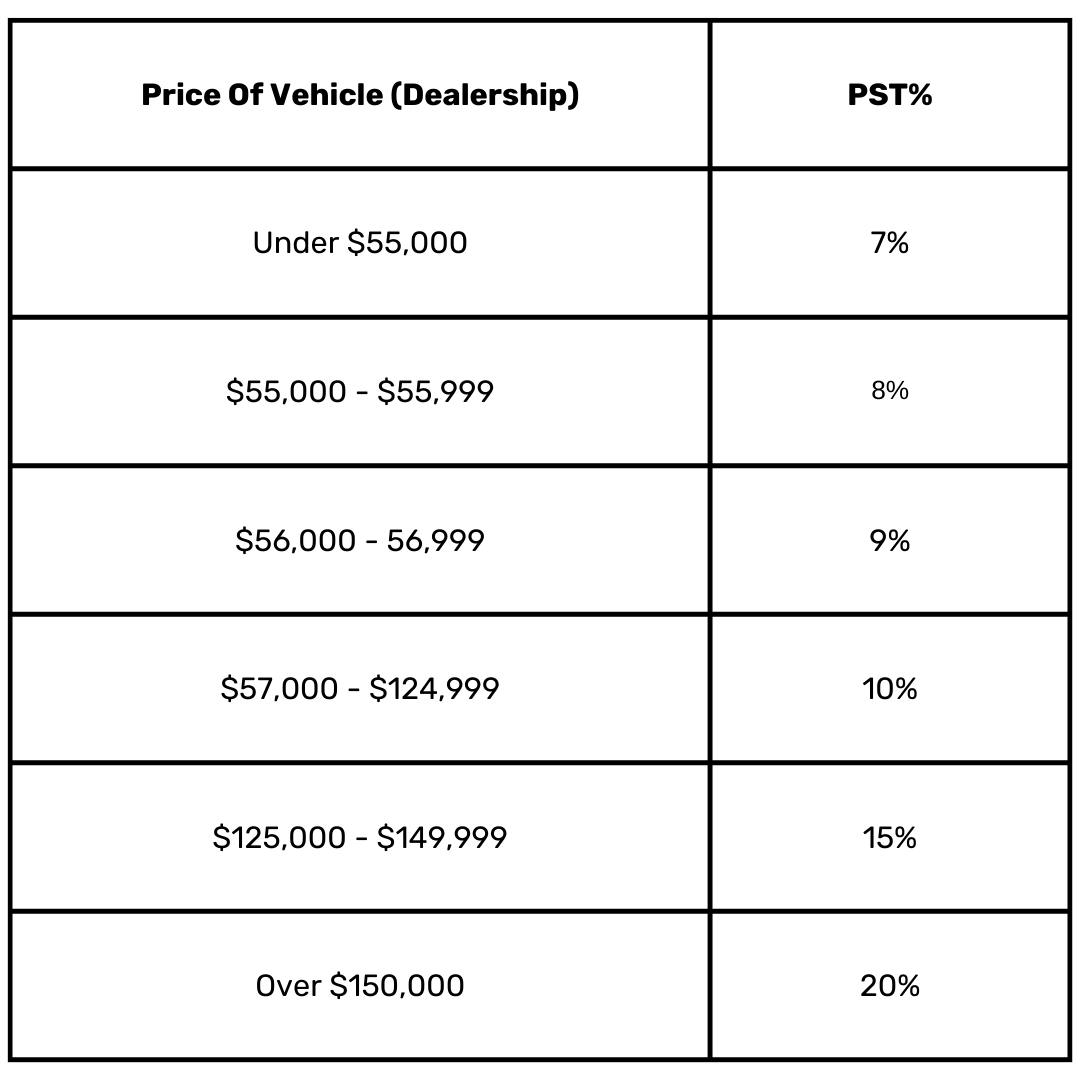

When making a purchase from a car dealership, the used cars will have an additional GST% and PST% charge. While the GST% is a fixed 5%, the PST% keeps increasing from 55,000$ dollars onwards. The following chart neatly illustrates the increase of PST% with increase in sale price of the used car.

![How To Avoid Paying Taxes On Used Car Purchases In BC [2025]](https://images.prismic.io/autolendinghub/Z0GBlq8jQArT1Oj8_image3.png?auto=format%2Ccompress&rect=0%2C177%2C1127%2C564&w=3840&fit=max)

![British Columbia Used Car Tax | Used Vehicle Tax In BC [2025]](https://images.prismic.io/autolendinghub/aBA3OvIqRLdaBsPl_midsection-customer-signing-contract-table_1048944-6900322.avif?auto=format%2Ccompress&rect=0%2C52%2C626%2C313&w=3840&fit=max)

![How Much Credit Score is Required For Car Loan in Canada? [2025]](https://images.prismic.io/autolendinghub/Z5peVpbqstJ9-AaC_pexels-photo-7236362.jpeg?auto=format%2Ccompress&rect=0%2C94%2C1125%2C563&w=3840&fit=max)