Compare Current Interest Rates on Car Loans in BC

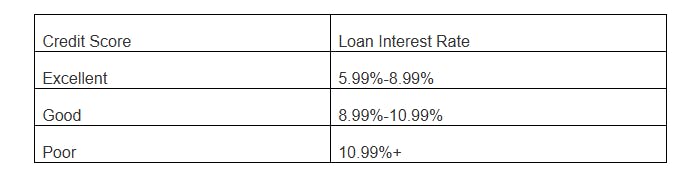

Have you heard of bad credit car loans? At Auto Lending Hub, you can qualify for car loans with any credit score history. Credit car loans in BC typically require you to assess your credit score as it is associated with the loan amount you will be paying and the interest rate you may be charged. It directly affects your car loan interest rate. Let us take a look at the current car loan rates in BC according to Statistics Canada: